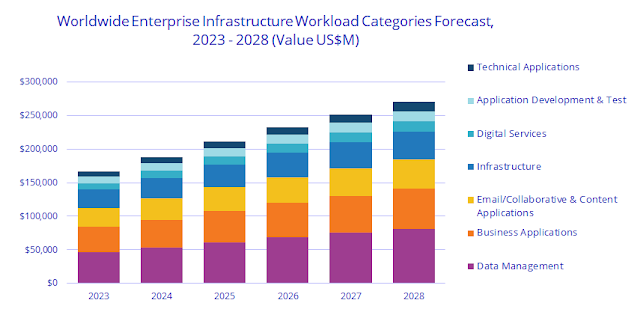

The importance of data in today’s business landscape fundamentally reshapes how CIOs invest in their IT infrastructure. A recent International Data Corporation (IDC) market study highlights this trend, revealing insights into spending patterns.

The study indicates that structured database and data management workloads are the largest spending category within enterprise IT infrastructure. This is unsurprising, considering the foundational role these workloads play in managing digital business data.

However, IDC’s worldwide market study also sheds light on a noteworthy shift – spending in some categories witnessed a slight decline in 2023 compared to 2022.

Data Workload Market Development

This dip could be attributed to several factors. Organizations might optimize their existing data management processes, potentially leveraging more efficient storage solutions or cloud-based data management services.

Additionally, the rise of alternative data sources, such as unstructured and semi-structured data, could be diverting some investment away from traditional structured data management.

A beacon of new growth is the Artificial Intelligence (AI) Lifecycle workload category. This segment, encompassing the entire spectrum of AI development and deployment, saw a 26.6 percent increase in spending year-over-year.

This surge reflects the adoption of AI across industries, as more businesses leverage its power for tasks ranging from marketing automation and customer service chatbots to product development and risk management.

The exponential growth in AI workloads necessitates a robust IT infrastructure capable of handling the intensive computational demands of emerging AI algorithms.

This translates to a growing need for high-performance computing resources, specialized storage solutions for massive datasets, and robust networking infrastructure to facilitate data flow.

While AI stands out as a frontrunner, several other workload categories exhibited healthy double-digit growth. Client computing, encompassing spending on desktops, notebooks, and peripherals, witnessed significant growth.

This trend can likely be attributed to the ongoing shift towards remote and hybrid work models, necessitating investments in endpoint devices that empower a distributed workforce.

Development tools and applications also saw a rise in spending, signifying the continuous importance of in-house software development capabilities for digital business transformation.

Text and media analytics, along with business intelligence and data analytics, experienced growth as well, highlighting the increasing focus on extracting valuable insights from data to inform strategic decision-making.

The IDC market study also underscores the dominance of public cloud spending within the IT infrastructure landscape. Cloud spending is projected to maintain a steady growth trajectory, with a compound annual growth rate (CAGR) of 12.8 percent over the next five years.

This trend is indicative of the numerous advantages cloud computing offers, including scalability, agility, and cost-efficiency. The study findings further emphasize the role of public cloud environments in supporting AI workloads.

Spending on AI lifecycle management within cloud environments is expected to reach $11.6 billion by 2028. This highlights the growing synergy between cloud computing and AI, as IT organizations leverage the cloud’s inherent capabilities to power their AI initiatives.

Outlook for IT Infrastructure Applications Growth

In conclusion, the landscape of IT infrastructure spending is undergoing a significant transformation. Data workloads, particularly those related to AI, are taking center stage, driving demand for high-performance computing, advanced storage solutions, and robust networking infrastructure.

That said, I believe the dominance of public cloud spending underscores the critical role of these platforms in enabling agility, scalability, and cost-effectiveness for businesses navigating this data-driven world. This is a key investment trend.

As we move forward, it is evident that leaders who adapt their IT infrastructure to accommodate the evolving demands of AI data workloads and strategically leverage public cloud services will be positioned to thrive in the Global Networked Economy.