As a seasoned industry consultant with roots dating back to the early days of Low Earth Orbit (LEO) satellite networks, I’ve witnessed firsthand the evolution of satellite technology and its transformative impact on global communications connectivity.

Today, we stand on the cusp of another significant leap forward with the emergence of Very Low Earth Orbit (VLEO) satellites. A recent market study by Juniper Research sheds light on this emerging technology and its potential to revolutionize various industries.

VLEO Satellite Market Development

VLEO satellites, operating at altitudes between 150 and 450 kilometers above the Earth’s surface, represent a new frontier in satellite technology. These satellites offer unique advantages over their higher-orbiting counterparts, including enhanced imaging resolution, lower latency, and improved operational efficiency.

As the demand for high-resolution Earth observation and faster communication speeds continues to grow, VLEO satellites are poised to play a crucial role in meeting these needs.

The Juniper Research market study highlights several key points that underscore the potential of VLEO technology. First and foremost, the market for VLEO satellites is expected to experience substantial growth in the coming years.

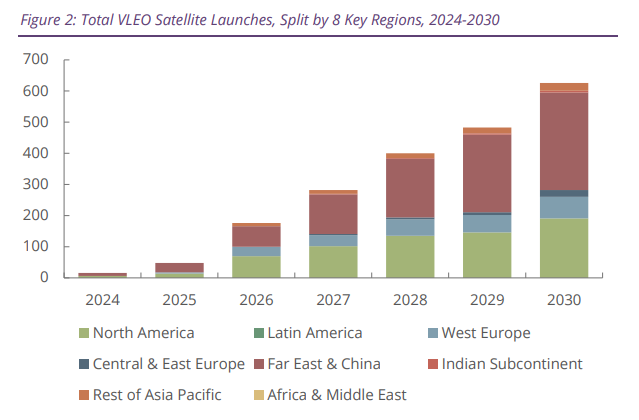

Juniper forecasts that the total number of VLEO satellite launches will increase from 16 in 2024 to over 620 by 2030. While this figure may seem modest compared to the projected 23,700 LEO launches in the same year, it represents a big step forward for this nascent technology.

The financial implications of this growth are equally impressive. According to the Juniper study, investment in VLEO satellites is projected to reach $220 billion by 2027 — that’s up from $17 billion in the current year. This rapid increase in investment underscores the growing confidence in VLEO technology and its potential applications across various sectors.

“Future leaders must focus on industries including telecommunications, navigation and environment monitoring, as these are the best long-term monetization opportunities; owing to the requirement for global connectivity that terrestrial technologies will be unable to provide, said Ben Clark, associate analyst at Juniper Research.

One of the most intriguing aspects of the Juniper market study is its ‘Future Leaders Index’, which identifies the pioneer companies about to become leaders in this emerging market.

The top five future leaders named are Thales Alenia, LeoLabs, Redwire, Blue Canyon Technologies, and Albedo. These companies are expected to apply their significant funding and expertise to develop VLEO satellite services, particularly in software-based solutions.

The study also highlights key industries that stand to benefit from VLEO technology, including telecommunications, navigation, and environmental monitoring. These sectors offer the most promising long-term monetization opportunities, driven by the growing need for global connectivity that terrestrial technologies cannot fully address.

From my perspective, having been involved in the LEO satellite industry since its early days as the first employee of Iridium North America, I see tremendous potential in VLEO technology.

The advantages offered by these low-orbiting satellites – including higher-resolution imaging, lower latency, and reduced power requirements – address many of the limitations faced by current satellite systems.

However, it’s important to note that the VLEO market is not without its challenges. The denser atmospheric environment at lower altitudes presents technical hurdles that must be overcome. Advances in materials science, propulsion systems, and miniaturization technologies will be crucial in ensuring the longevity and effectiveness of VLEO satellites.

Looking ahead, I believe we’re on the brink of a new era in satellite technology. The applications for VLEO satellites are vast and varied, from improving disaster management and urban planning to enhancing maritime surveillance and agricultural monitoring.

As the technology matures and costs decrease, we can expect to see an explosion of innovative new service offerings and apps that leverage the benefits of VLEO capabilities.

Outlook for Global VLEO Satellite Investment Growth

The projected cumulative investment of $1 trillion by 2029 speaks volumes about the industry’s confidence in this technology. However, success will ultimately depend on the ability of future leaders to develop adaptable, software-based services that can evolve with changing use cases and market demands.

While challenges remain, the outlook for VLEO satellite technology is exceptionally promising. As someone who has witnessed the transformative power of satellite technology over the decades, I’m excited to see how this next generation of satellites will drive innovation.

That said, I believe the potential for improved global connectivity, enhanced Earth observation, and new space-based services is truly enormous. As we look to the future, it’s clear that the sky is no longer the limit — it’s the beginning of a new spacecraft era.