The global financial services marketplace is transforming, driven by the meteoric adoption of digital wallets. What began as a convenient way to store payment cards on smartphones has evolved into an ecosystem reshaping how billions of people manage money.

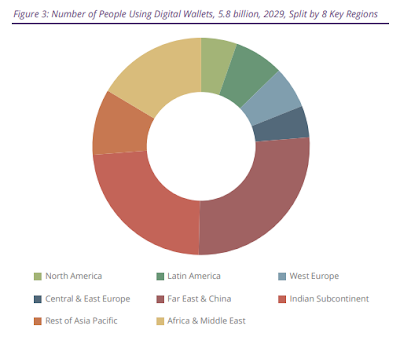

According to Juniper Research’s latest worldwide market study, digital wallet adoption is about to rise again, with user numbers projected to surge from 4.3 billion in 2024 to 5.8 billion by 2029.

This growth trajectory is about fundamental changes in how we access financial services. The most compelling Fintech transformation is happening in developing markets, where ‘Mobile Money’ solutions are bypassing traditional banking infrastructure entirely.

Digital Wallet Market Development

In regions with large unbanked populations, digital wallets have become the first point of entry into the formal financial system, allowing people to store, spend, and transfer money without needing a traditional bank account.

The market has evolved to support three distinct models: closed-loop systems for specific merchants, semi-closed networks for defined user groups, and open-loop systems that work across multiple merchants and platforms.

Each serves different needs and market segments, contributing to the technology’s widespread adoption.

The integration of Open Banking capabilities is a game-changer, allowing wallet providers to initiate payments directly from users’ bank accounts while never actually storing sensitive financial information. This not only enhances security but also reduces friction in the payment process – a crucial factor in user adoption.

Perhaps the most intriguing development is the rise of “superapps” – particularly in Southeast Asia and China. These platforms have transformed digital wallets from simple payment tools into comprehensive lifestyle applications.

Companies like WeChat and Gojek have shown that by combining payments with social networking, e-commerce, transport, and other services, digital wallets can become the centerpiece of users’ daily digital interactions.

This model has proven so successful that many Western companies in mature banking markets are now exploring similar approaches, albeit with varying degrees of success.

Several key trends will likely shape digital wallet market development.

First, the competition for user loyalty will intensify, with providers increasingly focusing on personalized rewards and incentives. The leaders in the space – including Huawei, Ericsson, and Comviva – are already differentiating themselves by offering advanced capabilities like micro-loans and innovative credit products in emerging markets.

QR code technology, despite being nearly three decades old, is experiencing a renaissance in the digital payments space. Its versatility in facilitating both merchant payments and peer-to-peer transfers, combined with its low implementation cost, makes it particularly valuable in markets where traditional payment infrastructure might be lacking.

In developed markets, where banking infrastructure is mature, digital wallet providers will need to focus on value-added services and better integration with existing financial systems.

In emerging markets, the opportunity lies in financial inclusion – providing basic financial services to populations that have been historically underserved by traditional banks.

Outlook for Digital Wallet Growth Opportunities

“These basic financial services allow wallet providers to diversify revenue streams. These providers must take advantage of mobile financial service licenses, where available, as they are often associated with a lower regulatory burden than full banking licenses,” said Michael Greenwood, senior research analyst at Juniper Research.

Looking ahead, I believe digital wallet capabilities will expand rapidly. The integration of artificial intelligence (AI), blockchain technology, and enhanced biometric security could open up new use cases.

For investors in this space, the message is clear: the digital wallet market represents a significant growth opportunity, but success will require more than just technical capability.

Understanding local market dynamics, regulatory requirements, and user needs will be crucial. Those who can combine these elements while delivering an integrated, secure, and valuable service will be well-positioned to capture a share of this rapidly expanding market.